crypto tax accountant ireland

In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. In Ireland crypto investments are treated just like investments in stocks or shares.

Crypto tax accountant ireland Monday February 14 2022 Edit.

. Crypto tax ireland Well help navigate you through the emerging world of cryptocurrency tax in Ireland. Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. This means that profits from crypto transactions are subject to capital gains tax at 33 at the time of disposal of the crypto whether thats a sale gift or exchange.

2 3 Edward Street Newbridge County Kildare. With our clear transparent pricing structure you can find a solution that suits your needs with no hidden extra costs. 97 Malahide Road Clontarf Dublin 3 Ireland.

However the first 1270 of your cumulative annual gains. 015677380 Client Reviews Moved to Liam Burns a year ago from a large contracting solutions provider as I felt their service is not personalised enough. Crypto Asset Tax Reporting CountDeFi Crypto Tax Countries we Support We provide crypto tax reports for South Africa United Kingdom United States of America Japan Australia Switzerland Spain Ireland France Norway and Germany.

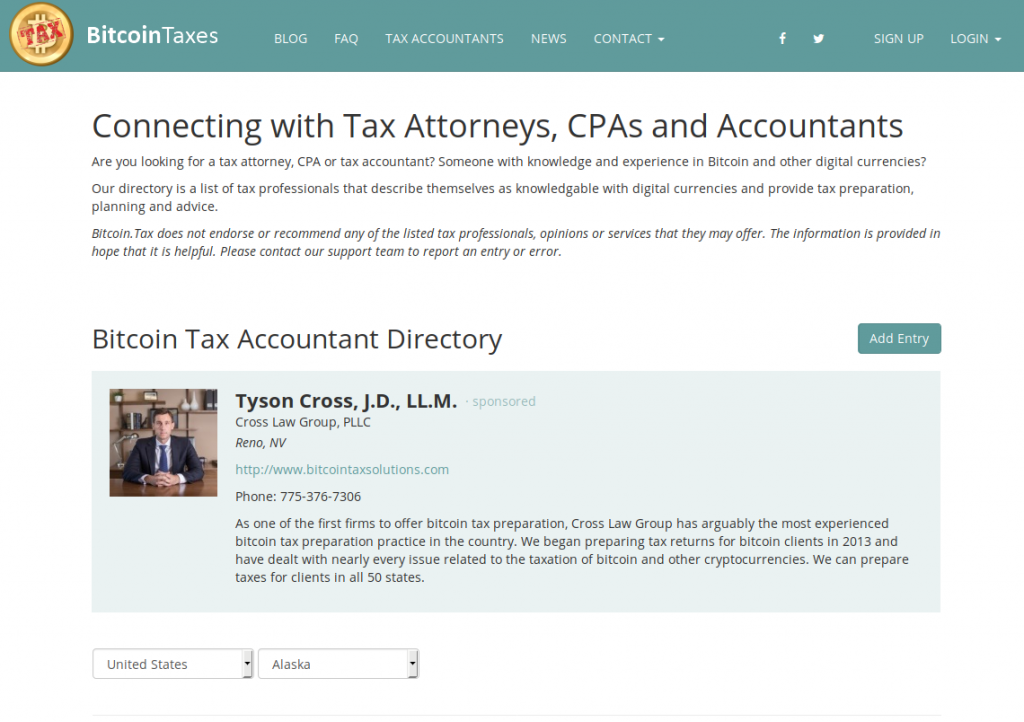

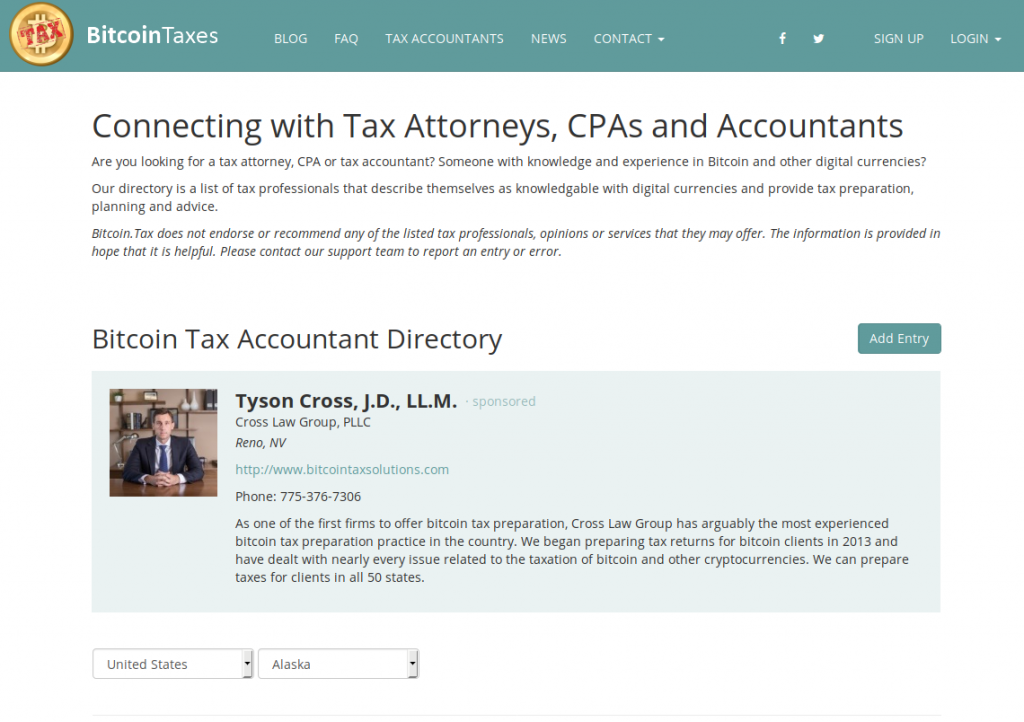

Simply copy the numbers into your annual tax return. In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT to Revenue. Crypto tax accountants in Ireland.

Yes Cryptocurrency is taxed in Ireland. We understand Crypto and DeFi income sources. There is also an annual tax-free allowance of 1270 so that only the profits exceeding this amount are taxed.

In summary Revenue have taken the stance that no unique tax rules are required for crypto assets - as such the taxation of income or gains arising from crypto assets is subject to. Our practice is dedicated to helping crypto investors manage their taxes. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income.

He is happy to. For disposals between 1st to 31st December you will have to pay Capital Gains Tax by 31st January of the following year. For Irish taxpayers crypto profits are taxed at the ordinary CGT rate of 33 for 2022.

27 January 2020 Jamie McCormick As cryptocurrency becomes increasingly more mainstream even if it still remains a niche among Irish users the Chartered Accountants Ireland have posted an interesting update to their coursework for receiving their accreditation. A Top 10 Service. Check out our free and comprehensive guide to crypto taxes.

In summary Revenue have taken the stance that no unique tax rules are required for crypto assets - as such the taxation of income or gains arising from crypto assets is subject to Irelands existing tax principles on a case-by-case basis - namely Capital Gains Tax CGT IncomeCorporation Tax VAT PAYE and Stamp Duty. If you sellexchangegift crypto between 1st January to 30th November you need to pay the tax by 15th December of the same year. Ireland accounting firm with experience in crypto taxation.

Well ensure you tax returns are accurate and up to date as you maximise your cryptocurrency gains. Colby Cross is a licensed CPA and expert on crypto taxes. While disposals of crypto assets attract CGT cryptocurrency received from mining staking and other similar activities attract Income Tax instead.

In Ireland crypto is typically taxed.

Best Crypto Trader Tax Report Tools

Accounting Flyer Images Browse 8 859 Stock Photos Vectors And Video Adobe Stock

Lalor Company Cryptocurrency Tax Services In Ireland Lalor And Company

Terra Ecosystem To Vote On A Fork To Create Luna Classic And Luna Core In 2022 Celestial Bodies Ecosystems Celestial

Cryptocurrency Tax Accountants In Canada Koinly

I M A Crypto Tax Attorney Ama Today Jan 27 Starting At 10 Am Est R Cryptocurrency

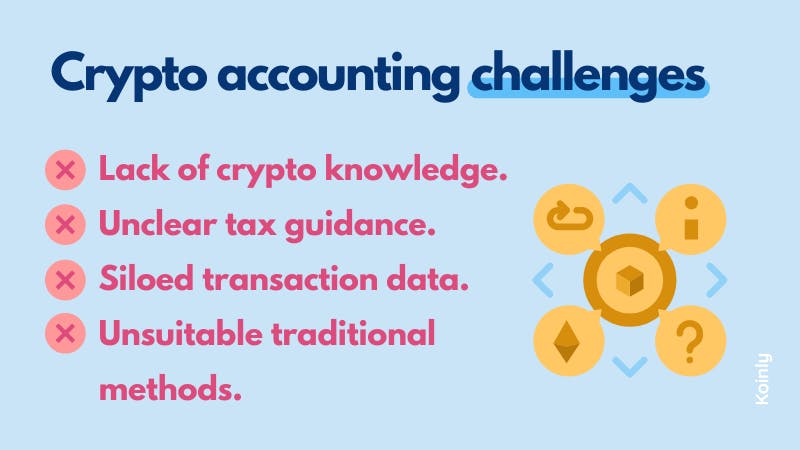

Cryptocurrency Accounting The Beginner S Guide Koinly

Calculating Your Crypto Taxes What You Need To Know

Crypto Tax Accountant Us Ca Uk Sa Solve Your Burden Today

How To Do Your Phemex Taxes With Koinly In 5 Steps Phemex Blog

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

I M A Crypto Tax Attorney Ama Today Jan 27 Starting At 10 Am Est R Cryptocurrency

When Do You Need A Crypto Accountant Koinly

Koinly Blog Cryptocurrency Tax News Strategies Tips

Vueling Accept Cryptocurrencies As An Alternative Method Of Payment With Bitpay Partnership In 2022 International Airlines Payment Digital